Survey Finds 2020 High School Graduates Delayed College Plans, Concerned about Financial Security (COPY_1683164300896)

Class of 2020 Significantly Impacted by COVID-19, concerned about financing college and financial future

Author: Ashley Charest

Work Readiness

Published:

Wednesday, 07 Apr 2021

Sharing

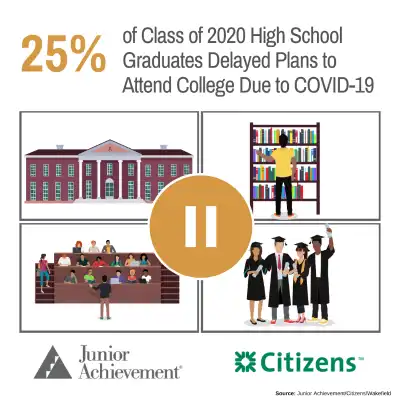

Image caption: Graduation Delayed Plans

COVID-19 has significantly impacted how teens are thinking about their financial futures, prompting 25 percent of 2020 high school graduates to delay their college plans in the face of reduced financial support from parents and guardians because of the pandemic, according to a new survey from Junior Achievement (JA) and Citizens. The findings, which indicate broad-based concern among teens regarding how they will pay for higher education, highlights an increased need for financial literacy curriculum that empowers them to make financial decisions that will impact them over the long term.

The pandemic has had a disproportionate impact on teens of color, with 60 percent of Black and 59% of Hispanic teens in 11th or 12th grade reporting that COVID-19 has affected how they will pay for college, compared to under half (45%) of their White peers.

The survey was conducted among 2,000 American teens ages 13 to 19 who are not in college and 500 teens who graduated high school in 2020.

“The past year has brought unprecedented challenges and uncertainty to everyone, and high school students are feeling this uncertainty as they navigate the transition to the next phase of their lives post high-school,” said Christine Roberts, Head of Student Lending at Citizens. “Equipping students with the skills and knowledge they need to make important financial decisions is critical to easing uncertainty and ensuring teenagers are able to make sound financial decisions.”

Despite showing greater uncertainty and anxiety among young people amid the challenges created by the pandemic, the survey revealed an overall sense of optimism among respondents, with a majority (74%) of teens who have not yet graduated high school remaining bullish about their financial future. Even with many delaying post-high school plans, most of the Class of 2020 (65%) remains optimistic overall about their financial future.

Many of those surveyed reported that COVID has prompted their families to pare back financial support for college. Nearly three-in-four (72%) Class of 2020 high school graduates planning to attend college expect their parents or guardians to pay at least part of their college education, and among them, 37 percent say their parents or guardians will cut back on their planned financial support for college education due to COVID. About four-in-five juniors or seniors in high school (81%) planning to attend college expect their parents or guardians to pay at least part of their college education, and among them, 43 percent say their parents or guardians will cut back on planned financial support for college.

“Last spring there was concern about how the pandemic would impact the Class of 2020, and this survey reinforces those concerns,” said Ashley Charest, President, Junior Achievement of Kansas. “After the financial crisis of 2008, we saw a doubling of student loan debt and young adults impacted by that situation delaying major life decisions, such as purchasing a home, starting families and planning for the future. It is important that we offer support for today’s teens experiencing the economic fallout from COVID. For Junior Achievement, that means providing education about critical life skills to help them navigate uncertain times.”

Additional survey findings include:

- More than half (55%) of Class of 2020 high school graduates have discussed their families’ finances more as a result of COVID, compared to just 44% of teens who have not yet graduated high school.

- Two-thirds of Class of 2020 high school graduates (69%) are somewhat or very concerned about the financial impact of COVID-19 on their families, compared to just over half (55%) of teens who have not yet graduated high school.

More information and an executive summary are available at this link.

Survey Methodology:

The JA COVID-19 Graduation Survey 2021 was conducted by Wakefield Research (www.wakefieldresearch.com) among 2,000 nationally representative U.S. teens ages 13-19 who are not currently enrolled in college, with an oversample of 500 students who graduated high school in 2020, between February 26th and March 8th, 2021, using an email invitation and an online survey.

Results of any sample are subject to sampling variation. The magnitude of the variation is measurable and is affected by the number of interviews and the level of the percentages expressing the results. For the interviews conducted in this particular study, the chances are 95 in 100 that a survey result does not vary, plus or minus, by more than 2.2 percentage points from the result that would be obtained if interviews had been conducted with all persons in the universe represented by the sample.

About Citizens

Citizens Financial Group, Inc. is one of the nation’s oldest and largest financial institutions, with $183.3 billion in assets as of December 31, 2020. Headquartered in Providence, Rhode Island, Citizens offers a broad range of retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations and institutions. Citizens helps its customers reach their potential by listening to them and by understanding their needs in order to offer tailored advice, ideas and solutions. In Consumer Banking, Citizens provides an integrated experience that includes mobile and online banking, a 24/7 customer contact center and the convenience of approximately 2,700 ATMs and approximately 1,000 branches in 11 states in the New England, Mid-Atlantic and Midwest regions. Consumer Banking products and services include a full range of banking, lending, savings, wealth management and small business offerings. In Commercial Banking, Citizens offers a broad complement of financial products and solutions, including lending and leasing, deposit and treasury management services, foreign exchange, interest rate and commodity risk management solutions, as well as loan syndication, corporate finance, merger and acquisition, and debt and equity capital markets capabilities. More information is available at www.citizensbank.com or visit us on Twitter, LinkedIn or Facebook.

About Junior Achievement of Kansas

Junior Achievement (JA) of Kansas inspires and prepares young people with the skills they need to succeed in a global economy. Collaborating with the business and educational community, JA of Kansas provides relevant, hands-on experiences that give students knowledge and skills based on the three pillars of financial literacy, work readiness and entrepreneurship. JA of Kansas serves over 28,000 students statewide. To learn more about JA of Kansas, visit www.kansasja.org or follow us on Facebook, Twitter, LinkedIn and Instagram.

Select a button below to see how you or your organization can get involved with Junior Achievement of Topeka, Inc..

Donate Volunteer Request A Program